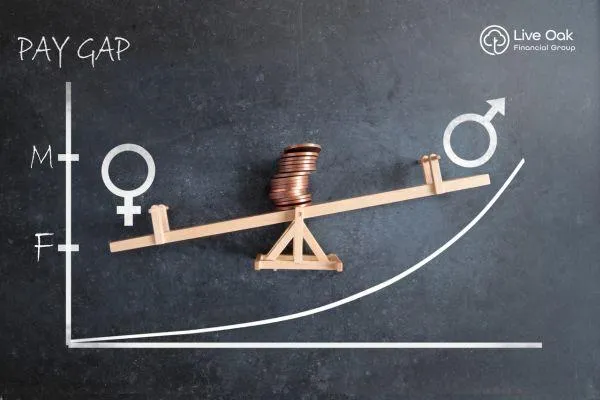

Women and Retirement: Closing the Gender Pay & Retirement Savings Gap

Today, women have greater access to education and job opportunities than in previous generations. However, despite these advancements, the gender pay gap and retirement savings disparities continue to persist. Even with more women participating in the workforce, significant wage differences between men and women contribute to a retirement savings shortfall. Why does this gender gap in retirement savings still exist, and how can it be addressed?

Why Does the Gender Gap in Retirement Savings Exist?

Pay Disparity: In the U.S., women earned an average of 82% of what men earned in 2022, as per the Pew Research Center. This gap means that women have less income to save and invest for their retirement.

Primary Caregiving Roles: Women are often the primary caregivers for children and family members, leading to career interruptions and reduced earning potential.

Re-entry Challenges: Returning to the workforce after a caregiving absence is more difficult for women, resulting in lost wages and reduced retirement contributions.

Controlled Pay Gap: Even when salaries are monitored and controlled for equity, women still earn 98 cents for every dollar men earn.

Managerial Representation: Women are less likely to hold upper managerial roles compared to men, which limits their opportunities for career advancement and higher earnings.

Global Earnings Discrepancy: Globally, women earn, on average, 63% of what men earn, based on the latest data from the International Labour Organization.

Time to Close the Gap: According to the World Economic Forum's Global Gender Gap Report 2023, it is projected to take 131 years to close the global gender gap completely.

Progress Towards Closing the Gender Gap

Despite these challenges, progress is being made worldwide to close the gender pay and retirement gap through various initiatives by governments, employers, and societal norms. Here are some promising trends:

Educational Attainment: Educational levels are becoming more equal between genders. Around 58% of women and 61% of men worldwide achieve an undergraduate degree or higher.

Workforce Participation: Globally, 47% of women are in the workforce compared to 72% of men. In developed countries, the rate rises to 53% for women and 69% for men, per the International Labour Organization.

Key Steps for Women to Achieve Retirement Readiness

There are essential steps that women can take to prepare for retirement, even when facing career interruptions or caregiving responsibilities. These steps form the foundation for a secure retirement:

Consistent Saving: Start saving early and contribute consistently to retirement accounts.

Financial Planning: Develop a comprehensive financial plan that accounts for both current living expenses and long-term retirement goals.

Backup Planning: Create a contingency plan for unexpected events that may impact your finances.

Healthy Lifestyle: Maintain a healthy lifestyle to reduce future healthcare expenses.

Continual Learning: Keep learning and developing skills to remain competitive in the workforce.

Building a Personalized Financial Plan

Women should create a financial plan that accounts for time away from work and does not rely solely on a partner's income. Having an independent financial strategy will prepare them for future uncertainties and ensure financial stability, regardless of life circumstances. If you are a woman seeking a financial plan tailored to your unique situation, contact us to set up a consultation.

Disclosure: The information in this article is provided as a service and is sourced from reliable third-party sources. Accuracy and completeness, however, cannot be guaranteed. The information should not be used as the sole basis for making financial decisions or as personalized advice. Reference Number: 1124573-b